Here we go again! Another new year has arrived. Happy 2024 to one and all!!

Although 2023 did test some people’s patience, in the end, the year turned out well for most investors (those who stayed with it and didn't get bogged down in the volatility).

With this being an election year, the Purus Investment Committee anticipates more volatility in the markets. We also see opportunities going forward in fixed income as the Fed appears to, at least for now, have taken a pause and are maybe even contemplating a reduction in rates. The committee continues to remain optimistic about innovation and how it will shape our world and our investments in the years to come.

We look forward to a great 2024 with all of you. No matter what pie you enjoy, pecan, apple, coconut crème, etc., think of Purus as the crust that holds it all together!!

(We had to throw a pie analogy in for a laugh) 😊

Enjoy!!

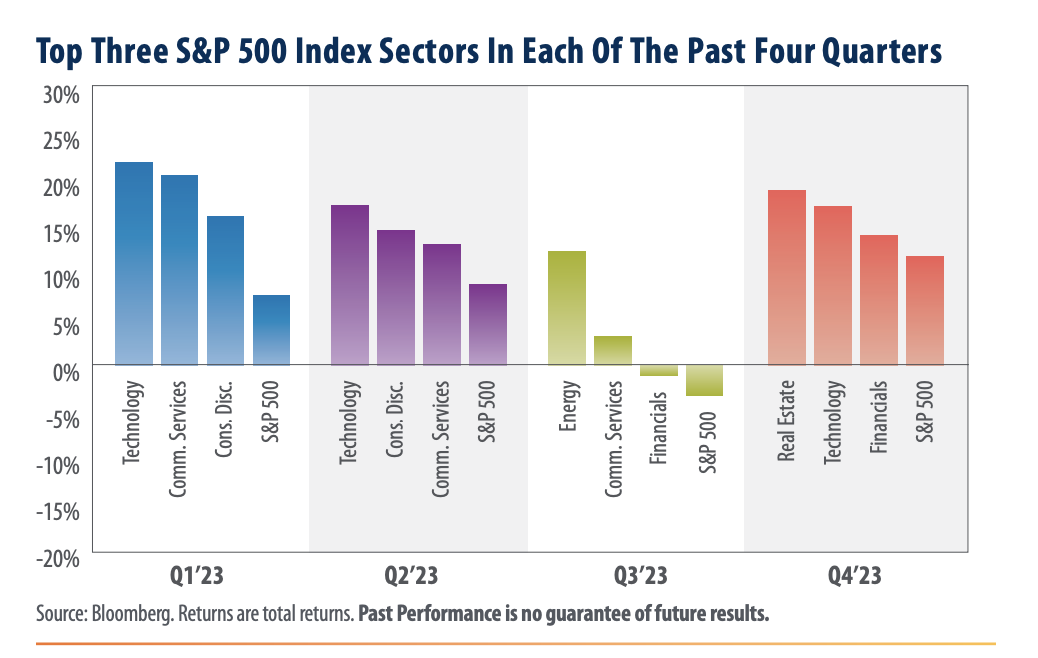

"One of the most common questions we field on an ongoing basis is the following: What are your favorite sectors? Today’s blog post is one that we update on a quarterly basis to lend context to our responses. Sometimes the answer is more evident than at other times, and sometimes it only makes sense via hindsight."

"Very early this year our economics team got a pleasant surprise: Consensus Economics, which collects forecasts from roughly 200 economists around the world, rated us the most accurate forecasters of the United States for 2022, based on our forecasts for GDP and CPI. Unfortunately, we don’t expect a repeat award for 2023."

"We cannot predict what theme will dominate the markets in 2024, but we can control how we react to positive and negative surprises by having a measured approach to portfolios."

“We are once again in uncertain territory. It’s precisely when the backdrop has looked so difficult that the markets have begun to recover. It’s hard to know when that turn will happen this cycle. But, based on prior experiences the market will turn eventually — and that should provide some solace.”

If you have any questions about this month’s topic, reach out to our cybersecurity team.